Strategy Examination of the Semiconductor Foundry Industry

- Nirav Shah

- Mar 3, 2025

- 52 min read

Updated: Apr 30, 2025

I analyzed TSMC, Samsung, and Intel in Spring 2024.

INTRODUCTION

The dawn of the transistor era was a key checkpoint in the history of humanity. Within a couple of decades, humans would land on the moon and a partial credit goes to the rocket’s computing power, equivalent to a modern-day pocket calculator. Due to the small form factor of electronics, the Apollo program carried lighter load in its rockets which resulted in accurate navigation. Today, computers have positively impacted every possible industry, from agriculture to transportation, from manufacturing to retail, from finance to law. And all of this is possible because of a single technology - semiconductors. They have entered our daily lives in everything remotely electronic that we use, touch, hear, and see. This industry has remained in a silo for a long time however the semiconductor shortages of COVID-19 pandemic made its ubiquity known to all.

Semiconductors have made it easier, cheaper, and faster to communicate and process data. It is imperative to understand the functioning of the diverse supply chain that entails this industry. The semiconductor industry is populated by a number of companies from design/fabless, manufacturing, Outsourced Semiconductor Assembly and Test (OSAT)/packaging, and original equipment manufacturers (OEMs) industries. It is pertinent to note that each of these industries are capital intensive which has resulted in a few companies reigning over large markets. For example, Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung are the only two companies that can manufacture transistors of leading edge nodes viz. 5nm and 3nm. The other company is Advanced Semiconductor Materials Lithography (ASML) which holds a monopoly on extreme ultraviolet (EUV) lithography equipment, priced at $200 million (Das & Das, 2023), that is used to manufacture the transistors of leading nodes. Intel, Nvidia, and Advanced Micro Devices (AMD) share the bulk of the fabless market revenue. To reduce labor costs, most of OSAT companies were shifted to East Asian countries in the 20th century. The industry has been dictated by Moore’s law which states that the number of transistors on a given area doubles every 18 months. Over half a century has passed and the industry has kept the pace of innovation intact. Protecting Intellectual Property (IP) in the form of designs and patents is a top priority for the semiconductor industry and frequent legal battles based on technology infringement and poaching have been witnessed.

A complex web of supply chain and logistics now runs the semiconductor industry which has global economic and political implications. The semiconductor shortage as seen during the COVID-19 pandemic has resulted in national governments rolling out semiconductor policies to effect, initiate, control, and become self-reliant in producing semiconductor IP and manufacturing. CHIPS and Science Act (US), the European Chips Act, the K-Chips Act (South Korea), Modified Programme for Semiconductors and Display Fab Ecosystem (India), and many others have promised large subsidies to national and global players in the form of funding, taxation, and land grants. Additionally, export limitations on semiconductor-based materials like processors, electronics, telecommunication equipment, encryption and information security equipment, sensors, and lasers have been imposed as a result of the ongoing trade war between the United States and China (Wolf & Kalish, 2023). The semiconductor market size was valued at USD 527.88 billion in 2021 and is projected to grow from USD 573.44 billion in 2022 to USD 1380.79 billion in 2029, exhibiting a compound annual growth (CAGR) of 12.2% during the forecast (Semiconductor Market Size & Share | Industry Growth [2029], n.d.). This paper aims to conduct a strategy examination of the semiconductor industry, more specifically, its semiconductor manufacturing segment.

The paper comprises five sections that analyze the semiconductor industry including the Introduction. We present a short history and status quo of the industry’s major players from the available literature. Further, we describe the strategy theories and frameworks of analysis that are used as lenses to look at the semiconductor industry. Current market trends and their characteristics are discussed after that upon which three major players in the semiconductor manufacturing industry are selected. Having selected the players, we apply the strategy theories to develop an understanding of the current state of affairs therein. Finally, the paper concludes with learnings and insights of the said industry along with the strategic impact of the three players, comparisons between the players, and which firm has a sustainable competitive advantage.

LITERATURE REVIEW

Semiconductor Industry Evolution

In 1947, the transistor was invented at Bell Labs by John Bardeen, Walter Brattain, and William Shockley (Bardeen & Brattain, 1948). The semiconductor technology has evolved significantly since then followed by the development of the integrated circuit in the late 1950s (Kilby, 1976). As seen in Figure 1, the time required to invent new types of transistors has been steady at the courtesy of Moore’s law (Moore, 1998). The majority of scaling in the 1970 to 2020 period has been of the existing metal-oxide-semiconductor field-effect transistors. This led to higher power efficiency and doubling of computer speed every two years while the costs remained the same. Semiconductor is one of the unique industries where the industries have deflated the cost of their products. However, the initial breakneck pace of innovation and deflation has slowed down after the 2000 (Cass, 2023).

The semiconductor industry evolved from finding its applications in the military. As semiconductors offered smaller size, better precision, and lighter weight, the United States (US) government, mainly the Air Force and NASA were customers of the early organizations like Fairchild Semiconductors and Texas Instruments that manufactured semiconductors. Their early technologies were used in missile guidance. However, Fairchild Semiconductors soon pivoted to the industry and commerce, like the personal computer market, as it was a bigger opportunity than the government contracts (Miller, 2022).

Earlier, integrated device manufacturers (IDMs) like Intel monopolized the markets as they were vertically integrated from design to manufacturing. Companies wanting to produce their own products had to comply with Intel’s architecture so that Intel could manufacture it for them. A significant breakthrough in this environment was the Foundry model created by Morris Chang, the founder of Taiwan Semiconductor Manufacturing Company (TSMC) in 1987. TSMC adopted an emergent strategy and specialized in semiconductor fabrication and provided services to fabless design companies. Furthermore, the fabless semiconductor design model emerged as a response to the creation of the foundry model and ever-increasing complexity of chip design and fabrication. Companies like Qualcomm and Nvidia adopted the fabless model, another emergent strategy, and outsourced manufacturing to foundries (Steve Blank, 2022).

Figure 1, Invention to Commercialization of Types of Transistors (Cass, 2023)

Simultaneously, electronic design automation (EDA) companies offered integrated circuit (IC) design tools that can simulate chip designs. Over the years, Taiwan and South Korea have had an increasing role in the semiconductor manufacturing industry while the US has retained a dominant role in chip architecture and design which also includes EDA companies. The US also had a major role in creating the semiconductor equipment manufacturing industry, or the semiconductor OEM industry but over time Japan and Netherlands have gained comparable market shares (Miller, 2022).

Semiconductor Industry Overview

The semiconductor industry is a complex web of supply and demand, from the raw material providers to the end consumer as shown in Figure 2 with chip design, manufacturing, OEM, and packaging being the key sub-industries. This section gives a brief overview of the giants in the semiconductor industry ecosystem which are addressing the heightened demand of semiconductor chips through design, complex manufacturing, packaging, and testing, thereby influencing prices and availability of products.

Fabless- A fabless company on the other hand develops and holds intellectual property of semiconductor design and outsources its productions. Examples of fabless companies are Nvidia and Qualcomm. One of the Fabless design companies is Nvidia. Nvidia was incorporated in Delaware and is based in Santa Clara, California. Nvidia makes and provides graphics processing units (GPUs), cloud services, application programming interfaces (APIs), system on a chip (SoC) units for the mobile computing and automotive market. Nvidia has a huge IP portfolio and drives its business model. It also has an alliance with TSMC for manufacturing its chips (Fernando, 2024). Nvidia has a revenue of $26.91 billion for the year 2022 (Document, n.d.).

Figure 2, Segments of the semiconductor industry (Zaman, 2023)

Another major fabless player is Qualcomm. It is a multinational semiconductor and telecommunications corporation, headquartered in San Diego, California, that develops wireless communications systems. Qualcomm's patented CDMA (code division multiple access) technology is used by telecommunications firms all over the world and has been crucial to the advancement of wireless communications. The Snapdragon processor series is famous and found in many leading smartphones like Samsung. In 2022, Qualcomm brought in $42.1 billion. (Reiff, 2023).

Semiconductor Manufacturing- A semiconductor foundry mainly produces integrated circuits (ICs) for other companies based on the designs they are given. TSMC and Samsung are the two biggest semiconductor manufacturers.

Multinational semiconductor contract manufacturing and design company Taiwan Semiconductor Manufacturing Company Limited (TSMC) is based in Taiwan. TSMC serves the majority of the top fabless semiconductor firms, including AMD, Apple, ARM, Broadcom, Marvell, MediaTek, Qualcomm, and Nvidia. By 2020, TSMC will have produced thirteen million 300 mm-equivalent wafers annually globally, meeting customer demand for semiconductors with process nodes ranging from two microns to three nanometers. In addition to being the first foundry to commercialize extreme ultraviolet (EUV) lithography technology in large quantities, TSMC was also the first to sell production capabilities as small as 5 and 7 nanometers (TSMC, 2024). The market value of TSMC as of 2024 is $608.15 billion, while the company's revenue for 2022 is $73.86 billion, based on TSMC's financial reports (TSMC (TSM) - Revenue, n.d.).

With its headquarters located in Yeongtong-gu, Suwon, South Korea, Samsung Electronics Co., Ltd. is a prominent global firm focused on consumer electronics and appliances. According to Samsung Electronics (2024), Samsung is among the top five semiconductor businesses globally and is the world's largest maker of semiconductor memory. 65.6 billion dollars were earned by Samsung from semiconductors in 2022 (Samsung Electronics Announces Third Quarter 2023 Results, n.d.).

OEM- An OEM is a company that manufactures the equipment used for semiconductor manufacturing. Established in 1984, ASML (Advanced Semiconductor Materials Lithography) is a worldwide company based in the Netherlands. ASML is a leader in the design and production of photolithography equipment used in the fabrication of computer chips. By 2023, it will be the leading provider to the semiconductor industry and the only manufacturer of EUV photolithography equipment needed to produce the most sophisticated devices. With a market valuation of over US$280 billion as of June 2023, ASML was the most valuable tech business in Europe (ASML Holding, 2024).

OSAT- An OSAT is a company that provides assembly, packaging, and testing to the semiconductor manufacturing industry in order to complete the chipmaking process. With its main office located in Kaohsiung, Taiwan, Advanced Semiconductor Engineering (ASE) offers independent services for semiconductor assembly and test manufacturing. With a 19% market share, ASE is the biggest OSAT provider. The business provides services like testing, packaging, and semiconductor assembly. ASE serves more than 90% of the global electronics industry with semiconductor assembly and testing services. System in package (SiP), flip chip, 2.5D and 3D packaging, fan-out wafer-level packaging (FO-WLP), wafer-level chip-scale packaging (WL-CSP), and copper wire bonding are among the packaging services offered (ASE Group, 2023). Consolidated revenue for ASE Technology Holding (ASEH) increased 17.7% year over year to a record $22.1 billion in 2022 (Taipei, 2023).

With its headquarters located in Tempe, Amkor Technology provides test services and packaging for semiconductor products. Amkor Technology deals in wafer level packaging and chip assembly via thermal compression (Amkor Technology, 2024). In the fiscal year 2022, Amkor generated $7.1 billion in revenue (Amkor, 2023).

Semiconductor Manufacturing Industry Segments

The semiconductor manufacturing industry makes multiple types of semiconductors that are used in different applications. The major manufacturing segments are memory, microprocessor, GPU, and analog chips (Team, 2022).

Memory- Memory chips are used to store data on storage devices. Commonly known memories are Random Access Memory (RAM) which is used to store data and remain available for use temporarily and Read-only memory (ROM) which is used to store data for longer periods of time. All electronic devices have some form of memory chips within. The memory market in 2022 was $130 billion (Deloitte, 2024).

Microprocessor- Microprocessors contain digital logic chips that are used to function as central processing units (CPUs). They are largely used in consumer electronics and servers. The microprocessor market in 2022 was $108 billion and is expected to grow at a CAGR of 7.1% from 2023 to 2030 (Grand View Research, 2024).

GPU- GPUs are used for displaying graphics which require higher computation as compared to microprocessors. GPUs perform computations in parallel which allows them to be quicker than CPUs. The GPU market in 2022 was $40 billion and is expected to grow to $400 billion by 2032 with a CAGR of 25% (Thomas Alsop, 2023).

Analog- Analog chips are used for power management, signal control in sensors, displays, and transceivers. Analog chips form an integral part of the communication equipment. The Analog chip market in 2023 was $83.91 billion and is expected to rise to $88.9 billion by 2024 which is a CAGR of 6% (Thomas Alsop, 2023).

Semiconductor Uses and Applications

Semiconductors are widely used in electronic products. The most common use of a semiconductor is in a transistor. Today, billions of transistors operate on a microprocessor that runs our smartphones. However, semiconductor technology is used in a wide variety of cases like diodes, solar cells, displays, memory devices, sensors, and control systems.

Figure 3, Applications of semiconductors (KnowMade, 2023)

Referring to Figure 3, electronic devices like computers, smartphones, refrigerators, air conditioners, televisions, wearables, cameras, servers, etc. operate on ICs made of semiconductors. In the automotive industry, semiconductors are used in advanced driver assistance systems, electric vehicles, and other control systems. Further, semiconductors find their applications in industrial automation systems, power electronics, and renewable energy. In the field of communication, they are used in wireless communication equipment like routers. Medical instruments and devices also require computing capabilities in imaging and diagnostic equipment. As previously mentioned, military equipment also heavily depends on semiconductors for precision and accuracy in missile guidance, radar systems, and communication systems (Team, 2023). The market for each of the above-mentioned categories is provided in the Industry Forecast section of this paper.

Strategies Theories and Frameworks for Analysis

The strategy theories and frameworks for analysis that shall be used to analyze the semiconductor manufacturing industry are described in this section hereafter.

Five Forces Framework- The five forces framework was first described by Michael Porter in his Harvard Business Review article in 1979. Companies can assess industry’s attractiveness, how the trends affect the competition in industry, and where should a company compete in the industry and how should it position itself with the help of this framework. Porter’s five forces include threat of new entrants, bargaining power of suppliers, bargaining power of customers, threat of substitutes and competitive rivalry.

Figure 4, The Five Forces That Shape Industry Competition (Porter, 1979)

Referring to Figure 4, the first force is Threat of New Entrants. New entrants enter the industry when it starts getting profitable. The new entrants offer more in lower prices to gain customers. The existing player is forced to match the competitive prices in order to retain their existing customers. Thus, the existing player has to take a cut in profit (Porter, 1979).

The second force is Bargaining Power of Suppliers. In any industry, suppliers bring the input. When the suppliers have a higher bargaining power, they set the higher prices for their products. However, this occurs when there is no competition among suppliers. If the number of suppliers is high, then customers may switch to other suppliers which reduces the bargaining power of the suppliers (Porter, 1979).

The third force is Bargaining Power of Customers. A strong customer lowers the price of a product and demands higher quality. This can occur when the number of customers is low and the number of suppliers is high (Porter, 1979).

The fourth force is Threat of Substitute Products. Companies make substitute products to the existing companies’ products. The level at which the substitute product satisfies the needs of customers determines the profit a company can make. If the substitute is more attractive, it reduces the profit (Porter, 1979).

The fifth force is Competitive Rivalry. Rivals compete on the basis of price, quality, service and marketing spend. Competitive intensity is the highest when buyers have many options, rivals have little service or product difference, and industry growth is waning (Porter, 1979). This framework would be used in investigating the major players in the semiconductor industry.

Resource Based View and VRIO Framework- Resource based view strategy emerged from the works of B. Wernerfelt, Hamel, Prahalad, and others during 1980-1990. The strategy highlights the importance of organizational resources and skills in gaining competitive advantage and improving performance. VRIO framework is a tool used within Resource Based View (Barney J, 1991).

VRIN architecture was introduced in 1991 by a distinguished professor of strategic management, but was modified later. The VRIO framework was the modified version of VRIN architecture. This framework examines if the resources and capabilities of the company can contribute to sustainable competitive advantages. VRIO framework categorizes the resources based on its value, rarity, imitability and organizational system (Barney J, 1991). The four aspects of the VRIO framework are valuable, rare, inimitable, and organization. This framework would be used in investigating the major players in the semiconductor industry.

Resources are considered to be valuable when they contribute in achieving the objectives in the form of products or services. A resource adds to its value when it helps in optimizing other factors like increasing profit and revenue, while decreasing external costs (Barney J, 1991). Resources which are not easily available and can be found by only a few are considered as rare resources. A company with these resources has a competitive advantage over others (Barney J, 1991). To stay competitive for a long time, it's important to make it difficult for others to copy your rare and valuable resources. This happens when the compensation for having these resources are greater than the costs that other companies would have to bear to imitate them (Barney J, 1991). For a resource to give a competitive edge, the organization needs to set up its operations, processes, and systems in a way that helps the resource achieve its highest level of productivity (Barney J, 1991).

Core Competency- The core competencies concept describes how large companies can prosper and achieve competitive advantage. In strategy, it is a widely recognized idea that is consistently applied in businesses and referenced in academic work. The distinguishing characteristics that set a company or business apart from competition are called core competencies. C K. Prahalad and Gary Hamel created a concept of a core competency in management theory. According to one definition, it is ‘a harmonized combination of multiple resources and skills that distinguish a firm in the marketplace’ and serves as the cornerstone of business competitiveness (C.K. Prahalad and Gary Hamel, 1990).

The intimation of core competencies is that companies should place a higher priority on the development of their core skills or hard skills and build their company model around those capabilities rather than concentrating an excessive amount of attention on areas on which they have low expertise.

Generic Business Strategies- Michael Porter initially suggested generic strategies in 1985 with his book "Competitive Advantage: Creating and Sustaining Superior Performance". A firm's profitability is determined by its relative position within its industry, which is higher or lower than the industry average. Long-term profitability is built on maintaining a competitive advantage. A firm's competitive advantage can be divided into two categories: low cost and differentiation. The two basic areas of competitive advantage, together with the scope of operations for which a firm seeks them, yield three broad strategies for outperforming the industry average: cost leadership, distinctiveness, and focus. Focus strategies are classified into two types: cost-focused and differentiation-focused (Barney, 2011). Cost leadership is a company's goal of becoming the lowest-cost producer in its industry. Cost advantages arise from a range of sources, which differ depending on the industry. They may involve pursuing economies of scale, proprietary technologies, and favored access to raw materials, among other things (Barney, 2011). In a differentiation strategy, a company seeks to be unique in its industry in some aspects that customers value highly. It selects one or more characteristics that many buyers in an industry regard as critical and positions itself uniquely to meet those needs. It is rewarded for its distinctiveness with a greater price (Barney, 2011).

The generic focus strategy relies on selecting a small competitive scope within an industry. The focuser selects a segment or group of segments in the industry and tailors its strategy to serve them at the expense of others. Focus strategies are classified into two types: cost-focused and differentiation-focused. In cost focus, a corporation seeks a cost advantage in its target segment, whereas differentiation emphasis seeks distinction in the same segment. Cost focus exploits variations in cost behavior in certain segments, whereas differentiation focus exploits the distinct wants of customers in specific segments (Barney, 2011).

Corporate and Cooperative Strategies- Corporate strategy is an organization's general plan or direction in achieving long-term goals. It involves formulating the company's mission, vision, values, and goals, as well as determining the markets and products on which it will focus, the competitive advantages it aims to build, and the resources and capabilities required to realize its goals (Barney, 2011). Corporate-level strategy comprises developing an operational plan to direct the organization's activities. As a result, the organization remains focused on its long-term strategic goals while remaining flexible enough to respond to market developments. Corporate strategy comprises making decisions about an organization's overall direction and scope. This includes deciding which industries and markets to compete in, distributing resources across several business units or product lines, and diversifying the company's product or service offerings. This strategy level is concerned with long-term goals and objectives, which usually include mergers and acquisitions, joint ventures, vertical integration, and other strategic alliances (Barney, 2011).

Corporate strategies are classified into four strategies based on internal and external factors. The growth-oriented strategies include entering new markets, expanding or diversifying existing ones, or leveraging economies of scale through forward or backward integration. The stability strategies are designed to reinforce an organization's current position while also building a strategic environment that will allow for greater flexibility in the future usage of expansion or retrenchment tactics. Stability plans are more conservative in character, with a focus on profit preservation, cost reduction, and examining future strategic options. The retrenchment strategies are reactions to unproductive or harmful aspects of a business or organization, such as the elimination of unprofitable assets or product lines. Organizations may mix the strategies outlined above, even if they appear to be conflicting. A combination strategy is effective when organizations are vast and operate in complicated environments, such as having multiple businesses in different industries with diverse needs (Barney, 2011).

A cooperative strategy (or cooperation strategy) is an organization's attempt to achieve its objectives by teaming with other firms. Collaboration could help to reduce costs, strengthen supply chains, reduce rivalry, contribute resources, expertise, and skill sets, and produce further synergies. Cooperation can occur between suppliers, consumers, unrelated businesses, or even competitors; antitrust laws may be involved. Typically, this cooperation takes the form of a strategic alliance. Strategic alliances have three common structures which are discussed below (Barney, 2011).

A Joint Venture operates similarly to a general partnership. Two or more firms work together for a specified period of time to achieve a specific aim. The companies work as partners to achieve their common commercial goals. As a result, every corporation has its own legal entity. An Equity Strategy Alliance is a business arrangement in which two companies invest in one another. As a result, both companies share ownership. In general, the agreement is a merger of equals in which each equity partner has equal power, authority, recognition, and ownership share. A Non-Equity Strategic Alliance refers to a legally binding agreement between two or more companies to collaborate and share resources. It may also require a dedication to operations and the relationship between the companies. Most firms do not share ownership. Any money exchanged or invested is a result of service or supply agreements between the companies (Barney, 2011).

INDUSTRY CASE

The semiconductor industry comprises four important areas: consumer electronics, automotive, telecommunication, and industry application. The global semiconductor market from 1987 through 2023 is shown in the following Figure 6, depicting a rise from $33 billion to $533 billion. New technologies like artificial intelligence, Internet of Things (IoT), 5G, and autonomous vehicles have arisen while the consumer electronics demand is expected to grow from $773.4 billion in 2023 to $1239.4 billion in 2030 which is a CAGR of 6.97% (Consumer Electronics Market, 2030). As a result of this growth, companies are trying to increase their manufacturing capacity and research and development by creating more fabs.

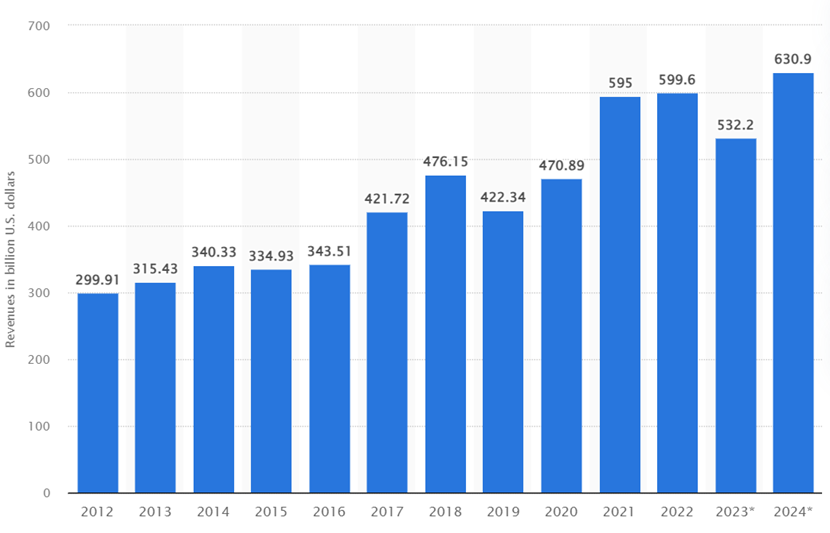

The size of the semiconductor market is projected to be $520.1 billion in 2023 worldwide. In 2023, there was a decrease in sales compared to the previous year. The market revenue in 2018 was $476 billion, in 2019 it was around $422 billion, $470 billion in 2020, $595 billion in 2021, and $599 billion in 2022. The year-on-year decline rate in 2023 from 2022 is equivalent to 9.4 percent. It is anticipated that a swift recovery will occur in 2024 and go upto $630 billion (Semiconductor Market Size 2024 | Statista, 2024). The semiconductor market is expected to be worth $1,307.7 billion by 2032. It's expected to grow at a rate of 8.9% every year from 2023 to 2032.

Figure 6, Global Semiconductor Market (Semiconductor Market Size 2024 |Statista, 2024)

Industry Forecast

Semiconductor sales have increased by over 20% to reach over $600 billion in 2021 (Burkacky et al., 2022). It is predicted that the industry would expand at an average yearly pace of between 6 and 8 percent until 2030, when it will have grown to a trillion dollar sector by the end of the decade. The value of semiconductors across various segments in the global market is displayed in Figure 7. Only three businesses are expected to account for over 70% of growth: wireless, compute and data storage, and automobiles (Burkacky et al., 2022).

Figure 7, Global semiconductor market value by vertical (Burkacky et al., 2022)

Characteristics of the Semiconductor Industry

The global semiconductor industry is predominantly led by companies hailing from the United States, Taiwan, China, South Korea, Japan, and the Netherlands. Even though the industry has been growing at an average rate of about 13% each year for the past 20 years, this growth has been paralleled by a heightened level of market volatility, contributing to significant, and at times dramatic, cyclical shifts. Consequently, there is a compelling necessity for companies operating within this sector to maintain high levels of adaptability and innovation to effectively navigate the rapid pace of market evolution. It is important because products with semiconductor parts often don't stay popular for very long, so companies have to be able to react quickly to what's happening in the market (Semiconductor Industry, 2024).

Continuous Moore’s law scaling- Moore's Law is a unique characteristic of the semiconductor industry. Gordon Moore, co-founder of Intel, predicted a doubling of transistors every year for the following ten years in his original paper published in 1965 (Moore, G. E., 1998). The semiconductor industry has kept pace with it by innovating and inventing new technologies. For example, dynamic random-access memory chips’ prices have been reduced by about 30% year on year for many decades (Bauer et al., 2013).

Cyclical pattern- The semiconductor industry operates in a cyclical pattern. It is subject to the ups and downs of the demand and supply cycles. In a favorable environment, semiconductor manufacturers struggle to meet demand. However, prices decrease when supply outpaces demand, which can occur from overproduction or a slowdown in end markets. Consequently, chip manufacturing levels also fall (Investor’s Business Daily, 2020).

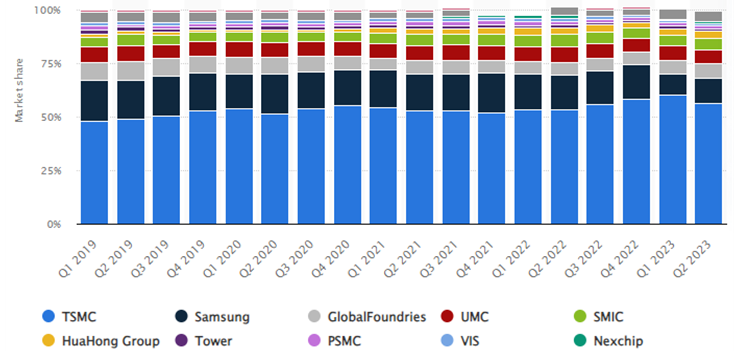

Global Dominance and Market Players- The manufacturing segment of the semiconductor industry is heavily dominated by two companies, namely TSMC and Samsung. However, Intel is aiming to catch up via its newly announced Foundry Services and hopes to become the second-largest semiconductor manufacturing company in the world by 2030. Samsung Foundry has a market share of 16.3% and TSMC has a market share of 53.6%. There are other players like United Microelectronics Corporation (market share 6.9%) and GlobalFoundries (market share 5.9%) that also have pure-play foundries. However, the former three hold a giant market share of the semiconductor manufacturing industry (Shilov, 2022).

Main Players

TSMC- The semiconductor manufacturing industry is largely dominated by two companies, TSMC and Samsung as mentioned before. TSMC had a meteoric rise due to the pure-play foundry model adopted by Morris Chang, TSMC Founder for the first time in the semiconductor industry (Sevastopulo & Hille, 2022). TSMC received substantial support from the Taiwanese Government. TSMC manufactures about 11,895 products for various applications in a number of markets such as smartphones, automotive, high-performance computing, IoT, and digital consumer electronics. Annual manufacturing capacity exceeded 16 million 12-inch wafers in 2023 (About TSMC, n.d.). Most of the top fabless companies such as Broadcom, Apple, AMD, ARM, Marvell, Qualcomm, MediaTek, and Nvidia are customers of TSMC. A few integrated device manufacturers such as Texas Instruments, Intel, STMicroelectronics, and NXP, outsource some of their manufacturing work to TSMC, which shows cooperation within the industry pertaining to technology expertise and capability (TSMC, 2024). TSMC employs 73,090 people and has a market capitalization of $600.32 billion making it the 10th most valuable company by market capitalization in the world (TSMC (TSM) - Market Capitalization, n.d.). Figure 8 shows TSMC’s growth from 2007 to 2023. In 2022, TSMC made $73.74 billion (Semiconductor Market Size 2024 | Statista, 2024).

Figure 8, Revenue Chart of TSMC (Taiwan Semiconductor Manufacturing (TSM) Revenue TTM: $68.864B USD, n.d.)

Samsung- The second largest semiconductor foundry is owned by Samsung. Samsung was originally founded as a trading business, but over the years it diversified into other areas such as textiles, insurance, food processing, securities, and retail, comprising 80 companies in total. Samsung entered the electronics industry in the 1960s and it formed several electronics-related divisions, such as Samsung Electro-Mechanics, Samsung Semiconductor & Telecommunications, Samsung Electronics Devices, and Samsung Corning. In 1974, Samsung acquired the company Korea Semiconductor which was on the verge of bankruptcy and marked its entry into the semiconductor industry. Samsung became the world's largest producer of memory chips in 1992. According to data from 2017, Samsung Electronics was the largest consumer electronics maker, in information technology and chipmaker measured by revenues (Samsung, 2024). Samsung Electronics employs 270,372 people according to data from 2019 and as of February 2024, Samsung has a market capitalization of $373.14 Billion, making Samsung the world's 22nd most valuable company by market capitalization (Samsung (005930.KS) - Market Capitalization, n.d.). Figure 9 shows the market growth of Samsung Electronics from 2010 to 2023. Qualcomm, Nvidia, AMD, IBM, Tesla, Sony, NXP, and STM are key clients of Samsung’s foundry. As of 2022, Samsung has 150 foundry clients (Taipei, 2022). In 2022, Samsung made $65.6 billion (Semiconductor Market Size 2024 | Statista, 2024).

Figure 9, Revenue Chart of Samsung (Samsung Electronics (SSNLF) Revenue TTM: $195.43B, n.d.)

Intel- A giant before TSMC arrived, Intel is today the third largest semiconductor manufacturing player. Robert Noyce and Gordon Moore, who were legends of Silicon Valley, resigned from Fairchild Semiconductors in 1968 and incorporated their new venture, Intel, with a commitment to innovation as a fundamental component of the company culture (Intel’s Founding, n.d.). Intel is a major supplier of microprocessors for computer system manufacturers and its x86 series of instruction sets can be found in most personal computers (PCs). Intel, being an integrated device manufacturer, also manufactures network interface controllers, flash memory, chipsets, GPUs, field-programmable gate arrays (FPGAs), and devices in computing and communications.

In 2023, Intel employed 124,800 people across the globe and had operations mainly in the four segments of client computing group which produces PC processors and other components, data center group which produces hardware components used in storage, servers and network platforms, IoT group which offers platforms designed for transportation, retail, industrial, home use and buildings, and programmable solutions group which manufactures programmable semiconductors (Intel, 2024). The market capitalization of Intel as of 2024 is $180.11 billion, which makes it the 64th most valuable company by market capitalization in the world (Intel (INTC) - Market Capitalization, n.d.). Figure 10 shows Intel’s growth from 2004 to 2023.

Intel has relaunched Intel Foundry Services following the foundry model championed by TSMC and is calling this phase IDM 2.0 led by their new CEO Pat Gelsinger. Their newly acquired customers are Qualcomm and Amazon Web Services. Other key clients include MediaTek, Taiwan, and the U.S. Department of Defense (Shilov, 2023). On January 25, 2024, Intel and UMC announced a collaboration for a 12-nanometer semiconductor process with FinFET technology. UMC is a high-quality IC fabrication foundry based in Taiwan. This collaboration will tend to markets of mobile devices, communications, and networking. The new process node will be developed in Intel’s Ocotillo Technology Fabrication location in Arizona (Intel and UMC Announce New Foundry Collaboration, January 25, 2024). In 2022, Intel made $58.4 billion (Semiconductor Market Size 2024 | Statista, 2024).

Figure 10, Revenue Chart of Intel (Intel (INTC) Revenue TTM: $54.228B, n.d.)

General Environment and Trends

When it comes to the manufacturing of semiconductors, there are very few players dominating the industry segment. As an example, Figure 11 above shows a chart with a market share of the semiconductor foundries. The contract manufacturers in Taiwan alone contributed to 60% of the total global foundry revenue in 2020 (Lee, 2021). This goes to show the kind of dominance Taiwan and companies like TSMC have in the industry. Moreover, referring to Figure 12, it is seen that most of the manufacturing is consolidated in Southeast Asia and China.

Figure 11, Semiconductor Contract Manufacturers by Market Share (Statista, 2024)

Figure 12, Semiconductor Supply and Demand by Region (Bartlett et al., 2023)

Therefore, there is a very high reliance on these companies to keep the supply chain functioning smoothly. The geopolitical tensions between the US and China for example, is an external environmental factor that has made it even more important for the US government to invest significantly in setting up semiconductor manufacturing plants in the country (Bartlett et al., 2023). Setting up manufacturing plants is a capital-intensive and time-consuming process. Once set up, the other challenge is to make sure the plant is up and running at full capacity. This requires experienced and talented professionals to run the operations, and currently, there is a low supply of talent in the semiconductor industry.

The growing imbalance in supply and demand because of the ever-rising applications of semiconductor chips, geo-political tensions between countries, consolidation of manufacturers in certain regions, talent shortage, and possibility of natural events has necessitated setting up manufacturing plants in different regions around the world to minimize the environmental effects in order to maintain the supply of semiconductors.

Industry Trends - The semiconductor industry is projected to generate a sale of $588 billion globally (2024 Semiconductor Industry Outlook, 2021). That is not only 13% greater than 2023, but also 2.5% higher than the record industry revenues of US$574 billion in 2022 (2024 Semiconductor Industry Outlook, 2021). This will be achieved with the help of the recent trends in the industry. In 2024, these trends are ready to reshape the industry.

The first trend is regarding power and efficiency of advanced chip design (2023). The pursuit of smaller, more powerful, and energy-efficient circuits fuels chip design innovation. The move to advanced semiconductor manufacturing methods, such as 5nm and beyond, enables the production of more densely packed transistors, resulting in devices that perform better while utilizing less power. This development will affect a wide range of applications, from mobile devices to data centers (Lauren Hart, 2023).

The second trend reflects the unparalleled processing power of quantum computing (Lauren Hart, 2023). Quantum computing is on the verge of changing the computing paradigm. While large-scale, operational quantum computers are still on the horizon, 2024 is projected to see substantial advances in this field. Quantum processors are expected to become more advanced, pushing the limitations of classical computing and allowing for the solution of hitherto intractable complicated problems (Lauren Hart, 2023).

The third trend discusses how nanotechnology is pushing the boundaries of miniaturization (Lauren Hart, 2023). Nanotechnology is critical in semiconductor manufacturing because it allows for the creation of smaller, more effective electronic components. We can expect additional advances in nanoscale materials and techniques in 2024, which will help to build nanoelectronics. This trend in addition helps with miniaturization, but it also improves the performance and capacities of semiconductor devices (Lauren Hart, 2023).

In addition to trends, various technology predictions have been made to describe the direction of the semiconductor business. Integration of edge computing (Lauren Hart, 2023) is one of these predictions. Edge computing will become increasingly important in semiconductor technology as the demand for real-time processing and low latency develops. In 2024, we expect to see more integration of edge computing capabilities effectively into semiconductor devices, allowing for quicker decision-making and increasing the efficiency of connected systems (Lauren Hart, 2023).

The second prediction is regarding the acceleration in artificial intelligence and machine learning (Lauren Hart, 2023). The collaboration between semiconductor technology and artificial intelligence (AI) is expected to grow. Dedicated hardware accelerators for AI and machine learning activities will become more common, providing greater performance and energy efficiency. This connection is critical for the progress of AI applications across a variety of areas (Lauren Hart, 2023). Subsequently, the third prediction regards cybersecurity in semiconductor design (Lauren Hart, 2023). With the increasing complexity of semiconductor devices, cybersecurity will become a critical factor in chip design. Secure hardware architecture and cryptographic approaches will be critical in protecting sensitive data processed by semiconductor devices (Lauren Hart, 2023).

Semiconductors are bound to develop in the future, and the trends that have emerged now lead to more innovation and competition. Global semiconductor sales are expected to accelerate in 2025-2026 before leveling around the 5%-6% yearly average recorded in the previous ten years (Semiconductor Market Trends to Watch Out for in 2024, 2023). Experts predict that the artificial intelligence sector will be worth $733.7 billion by 2027 (Semiconductor Market Trends to Watch Out for in 2024, 2023). It goes without saying that the expansions will necessitate more processors, integrated circuits, and advanced sensors. In some ways, these are dependent on semiconductor technology.

STRATEGY ANALYSIS

Porter’s Five Forces of Competitive Analysis

Threat of New Entrants - The factor that deters the new entrants is the semiconductor industry’s highly capital-intensive nature. A substantial amount of investment is needed in research and development, manufacturing facilities, and equipment (Hivelr Business Review, 2023). These factors make it difficult for any new entrants to enter the market.

Starting a new chip factory costs more than $1 billion and it becomes outdated after five years (The Business of Making Semiconductors | the Business of Making Semiconductors | InformIT, n.d.). The chip making plant can be really expensive if it is not being utilized at full capacity as fabs depreciate quickly. The Figure 13 depicts the worldwide utilization of IC fab for 12 quarters (three years) from the end of 1999 through mid-2002. Utilization dropped in 2001 as suppliers reduced production to meet declining demand. Unfortunately for them, their rent did not reduce, and the equipment continued to depreciate throughout this time. They simply invested $1 billion in a fab that produced only two-thirds of the chips predicted (The Business of Making Semiconductors | the Business of Making Semiconductors | InformIT, n.d.). This situation does not seem favorable to new entrants and also brings forth the known cyclical nature of the semiconductor industry.

However, given the criticality of the industry, there are some new entrants who are trying to enter this industry. Rapidus expects an investment of $54 billion from the government to be able to mass produce advanced logic chips by 2027 (Tim Kelly and Yoshifumi Takemoto, 2023). Another threat is of existing players ramping up their facilities to enter newer segments in the semiconductor industry. One such example is Semiconductor Manufacturing International Corporation (SMIC) from China. SMIC is ramping up their production with an investment of $8.87 billion for new chip plant in Shanghai for 28nm technology products (Reuters, 2021). Lastly, governments across the world, like India, are providing subsidies to set up semiconductor fabs. Yet, bringing a working chip sample takes two and a half years if everything works properly. After that the product needs to be tested, trial runs are necessary and getting orders from the customers. The whole process from getting the funding to generating revenue takes up to five years (How Much Does It Cost to Start a Fabless Semiconductor Company?, n.d.).

In addition to these problems, new entrants have high competition with the major players like TSMC, Samsung, and Intel. TSMC is well-known for its competence in new process technology, which allows the business to develop chips with higher performance, lower power consumption, and smaller size than competitors (Hivelr Business Review, 2023). This technological leadership, along with the reputation for quality, and economies of scale reduces the threat of new entrants for TSMC (Hivelr Business Review, 2023). Intel has long-standing partnerships in the industry which strengthens its position. The lengthy timeline as well as the existence of these major competitors can deter the new entrants from entering the market. Hence, the threat of new entrants is medium because of the subsidies that are being provided currently.

Bargaining Power of Suppliers - The suppliers in the semiconductor industry are responsible for the supply of raw materials and manufactured materials like silicon wafers, photomasks, and photoresists, along with certain chemicals which are essential for the manufacturing process. Even through all this the bargaining power of these suppliers is based on number of suppliers, switching costs, type of commodity (Damien Starek, 2012).

Figure 13, IC fab utilization worldwide for 12 quarters (three years) from the end of 1999 through mid-2002 (The Business of Making Semiconductors | the Business of Making Semiconductors | InformIT, n.d.)

The first factor that affects the bargaining power of suppliers. The market for fabrication materials is concentrated in the United States, Germany, Japan, Taiwan, South Korea, and China. Suppliers like Sumco (Japan), GlobalWafers (United States), Siltronic (Germany), SK Siltron (South Korea), and Soitec (France) collectively make up 65% of the global silicon wafer market (Thadani & Allen, 2023.). The large number of suppliers gives buyers a choice to switch to other suppliers, and decreases their bargaining power.

The type of commodity is another factor. There are two types of inputs, commoditized and specialized. In the case of commoditized inputs, TSMC has a relatively higher bargaining power because of its market share, long-standing relationships and large scale (Hivelr Business Review, 2023). However, the bargaining power is low for the specialized inputs. The reason behind this is that the number of suppliers who provide specialized inputs are less (Hivelr Business Review, 2023), and TSMC has less available options. Intel acquires specialized materials and equipment by entering into long-term relationships with suppliers (Hivelr Business Review, 2023). This creates interdependence between both the parties. But, Intel has the ability for bulk purchasing due to its size (Hivelr Business Review, 2023). This reduces the influence of suppliers and lowers their bargaining power.

The third factor is the switching cost. In the case of Samsung, it has more bargaining power over suppliers because of its scale. The financial strength of the suppliers is low, and their size is small. In addition to that, Samsung can switch suppliers easily (Pratap, 2017). But losing Samsung would affect the financial state of suppliers heavily. They need to follow the guidelines provided by Samsung and meet the specifications provided (Pratap, 2017). Hence, the high number of suppliers and dominance of buyers results in the bargaining power of suppliers to be moderate to low.

Bargaining Power of Buyers - The bargaining power of buyers depends on the factors like importance of products to the quality of buyer’s product, intensiveness of competition, product differentiation and cost of an item in proportion to the total cost (Damien Starek, 2012). Companies like Apple, Samsung, Xiaomi, Lenovo Dell Technologies, HP inc, Qualcomm and Nvidia form a major customer base in the semiconductor industry (STAMFORD, Conn., 2023). Subsequently, TSMC and Intel became the suppliers for these companies (Hivelr Business Review, 2023).

Companies like Apple, Qualcomm, and Nvidia form a customer base for TSMC (Hivelr Business Review, 2023). These companies have a higher bargaining power because they buy in huge quantities and are significant to TSMC’s revenue. The list of TSMC’s major customers is shown in Figure 14. TSMC’s customers also have alternative suppliers like Samsung and GlobalFoundries (Hivelr Business Review, 2023), which increases their bargaining power even more. TSMC is trying to mitigate the bargaining power of customers by establishing long-term relationships and investing in R&D (Hivelr Business Review, 2023). The customer base of Intel includes Dell, Lenovo and HP. Dell accounts for 19% of Intel’s total revenue, while Lenovo and HP Inc. accounts for 11% and 10% respectively of Intel’s total revenue (Intel - Wikipedia, 1968). These customers have limited alternatives that can match Intel’s level of performance, compatibility, and industry support (Hivelr Business Review, 2023). Intel is well-known in the industry for its brand recognition, technological leadership and reputation (Hivelr Business Review, 2023). Hence the bargaining power of buyers is high.

Figure 14, Leading customers of TSMC in 2021 (TSMC: Revenue Share of Leading Customers 2021 | Statista, 2022)

Threat of Substitutes - The threat of substitutes in the semiconductor industry depends on the factors like universality of the product, its technical complexity, and patents and/or legal barriers. Along with these, threats of counterfeit products are also considered (Damien Starek, 2012). Threat of substitutes ranges from low to medium in the semiconductor industry. This happens because the companies invest heavily in R&D and maintain their competitive edge. Along with that, companies like TSMC and Intel make it difficult for their competitors to bring a substitute that could duplicate the high complexity, precision, and performance of their products (Hivelr Business Review, 2023). The threat of counterfeit is dealt with the help of patents. Intel has an extensive intellectual property portfolio with 70,000 patents (Intel Public Intellectual Property Policy, n.d.). The threat of substitutes becomes high when a lot of companies bring products with similar functions to the market. This also becomes the case when the switching cost is low or modest. Samsung is an example of that, with competitors like LG and Sony, as well as other foreign and local brands, and a modest switching cost for the clients (Pratap, 2017).

The biggest threat to the semiconductor industry is quantum technology. Semiconductors are a basic element that only a fundamental change in the working of electronic devices can outplay the semiconductor industry. Google, IBM, and Intel are the major players involved in developing quantum technology. The threat is low because the applications of quantum technology for our daily computational tasks seem distant in the future.

Competitive Rivalry - The competitive rivalry is intense in the semiconductor industry due to its highly competitive nature (Hivelr Business Review, 2023). The factors that power competitive rivalry are technology development, pricing, and customer relationships (Hivelr Business Review, 2023). TSMC competes with other foundries like Samsung, Intel, and GlobalFoundries based on these factors. TSMC has maintained its position by investing in cutting edge technology, developing high-quality products and services at competitive prices, and maintaining long-term relationships with other companies like Apple and Nvidia (Hivelr Business Review, 2023). Even though Intel is a dominant player in the semiconductor industry, it competes with other companies like AMD and NVIDIA (Hivelr Business Review, 2023). Samsung competes with brands like LG, Apple, Microsoft, Philips (Pratap, 2017) to maintain its position in the market. Figure 15 summaries the Porter’s Five Forces framework.

Figure 15, Porter’s Five Forces Framework for the Semiconductor Manufacturing Industry

Resource Based View and VRIO Framework

TSMC - TSMC’s growth is determined by innovation. A strong skilled and knowledgeable workforce to unleash innovation is a valuable human resource. TSMC’s implementation of a blended learning model has enabled the company to conduct over 6,300 face to face training with 5,600 virtual classrooms meetings in 2022, with a combined total of 2.11 million trainees engaging in these learning activities. In 2023 TSMC served diverse patrons of 528 consumers across various industries (Taiwan Semiconductor Manufacturing Company Limited, n.d.). Chip industry is based on globalization with the supply chain market supporting it. TSMC fabs are faster and more accurate as compared to any rival because of the highly skilled and long hour labors. This reflects as a valuable and inimitable resource for the company (Taiwan’s Dominance of the Chip Industry Makes It More Important, 2023). TSMC has committed to provide exceptional services and products. They have facilitated the production of an extensive portfolio of 11,895 distinct products which was designed to address MEMS, CMOS Image Sensor, Embedded NVM, RF, Analog, and BCD-Power processes to meet the unique needs of industries like AMD, Apple, Broadcom, ARM, MediaTek, Marvell, Qualcomm and Nvidia. With this TSMC has the commitment of manufacturing excellence for quality and reliability of semiconductors in the research and development sector that is a rare resource of the company (Taiwan Semiconductor Manufacturing Company Limited 2010-2024). TSMC has maintained a strong focus on fabrication of IC chips that has resulted to be fruitful. Conversely Samsung and Intel have diversified their business methods, they incorporate chip design and other ventures but TSMC dominance is based on designing new technology nodes with ASML machines in mass production, they have been designing new nodes every few years with total expenditure of over 20 billion dollars, therefore the brand positioning of TSMC is a valuable resource through continuous innovation and IC development (Ask HN: Why Is TSMC so Competitive in Semiconductor Fabrication? | Hacker News, n.d). The company’s IC foundation strategy comprises an integrated approach that processes technology services and highlights TSMC innovation is based on active collaboration that is the alliance of TSMC partnerships including the Open Innovation Platform it plays an essential role in enabling the semiconductor industry to fully inherit the benefits of 3D IC technologies in terms to increase power, performance and optimization. TSMC facilitates consumers by introducing the next generation silicon designs through collaborative efforts and acquisitions. The acquisition of the resources is critical with TSMC's ability to vindicate its competitive edge in the market. TSMC collaborations distinguish itself from their competitors and mark a unique stand in customer’s minds and therefore signifies integrity, commitment, innovation and brand positioning as rare resources of the company (Taiwan Semiconductor Manufacturing Company Limited, n.d.). The TSMC Open Innovation Platform (OIP) enterprises a comprehensive design infrastructure with technology which aims to address critical IC implementation challenges and to simplify it to seamless design processes and improve the first time silicon fabrication success. It provides consumers a new and innovative way to design and develop better ICs. This indicates Open Innovation Platform as an inimitable resource of innovation acquired by TSMC, the technology is complex for competitors in the industry to imitate. The processes, manufacturing and trademarks of this technology make it difficult for the competitors to replicate the IC implementation (Taiwan Semiconductor Manufacturing Company Limited 2010-2024).With that enabling the realization of progressive and pioneering innovations and creating development in the field of semiconductor industry with the use of Open Innovation platform and strategies, it is impossible to imitate the IC fabrications in a more innovative and developed manner also intimate a good relationship with their partners (Taiwan Semiconductor Manufacturing Company Limited 2010-2024).

Intel- There are a number of valuable resources that Intel capitalizes on to improve performance and efficiency. Strong global presence is a valuable resource of Intel as it has expanded its network and manufacturing footprint across the globe giving it scale and capacity. Intel has 15 wafer fabs at 10 locations and a number of testing and assembly development facilities worldwide (How Many Manufacturing Fabs Does Intel Have? , n.d.). Intel also has a large network of store presence in locations around the world which gives it high visibility. Another valuable resource is Intel’s technological expertise in semiconductor design and manufacturing. This enables Intel to make cutting-edge microprocessors and other semiconductor products powering various computing devices. Intel developed multiple products that changed the future of technology such as the world’s first electronically programmable microprocessor and the world’s first electrically programmable read-only memory (EPROM) (Explore Intel’s History, n.d.). That reputation is sound to this day as Intel continues to shape technology through continued innovation. This gives Intel a unique place in the mind’s of customers and therefore the brand positioning of Intel is a valuable resource. Intel is known for its microprocessors since time immemorial and is widely known for its reliable and safe chips. This has helped Intel build a strong customer network and loyalty, making it a valuable resource. Customer loyalty does not come easy and it is certainly a rare resource. One can invest a lot of money into building customer loyalty but it is something which can only be imperfectly imitable. Innovation, and all the intellectual property associated with it, are central to Intel’s continued domination in the industry. Intel owns about 70,000 patent assets worldwide (Intellectual Property Policy , n.d.), which makes this an extremely valuable resource in thwarting competition. Speaking of intellectual property rights (IPR), copyrights and trademarks, these resources are rare and it will be very difficult for competitors to copy, therefore the risk of imitation is also low. Even if it were possible to come up with technology similar to Intel’s, it would only be imperfectly imitable. From the organization point of view, Intel has not utilized all of its IPR’s and other properties as some of it have not yet been granted and approximately 48% of these patents are active (Intel Patents - Key Insights and Stats - Insights;Gate, 2023). Intel has had only 6 people at the helm with the title of Chief Executive Officer (CEO) over 50 years of its existence (Yarbrough, 2013). This says so much about the stability Intel has had in the industry and how they are able to pass on the culture laid out by the founders. This reflects a unique aspect of the company's culture which is valuable, rare, inimitable and something which the business has successfully made us of. Financial reserve is another important resource of Intel which can be highly valuable. With substantial backing, Intel can invest in research and development (R&D), acquire new technologies and companies, and weather economic downturns. Intel can continue innovating and gain a considerable advantage over a lot of companies in the industry, which makes it a rare resource to some extent. However, it can be imitated by its competitors. From the organization’s perspective, Intel has made use of its reserves by investing heavily in R&D, customer loyalty, hiring talent, marketing, etc. Intel announced in 2021 an investment of about $43.5 billion in new manufacturing of semiconductor chips and R&D in the US.

Samsung- Samsung has maintained its brand image as a mobile phone and consumer electronics manufacturer by consistently delivering innovative products which are of top quality and at the same time providing great customer service. The presence of Samsung in so many industries is another reason why it has a wider reach among people. This brand image of Samsung gives it an edge over its competitors which is a very valuable resource for Samsung, difficult to imitate, and rare. Samsung is a very diversified brand with smartphones being the largest revenue generator, however it is not solely dependent on it. Samsung is a global brand in Mobile communication, consumer electronics, and displays. This diversification has helped Samsung establish itself as the largest technology brand in the world. The kind of product range Samsung has is not something which not a lot of companies in the industry have and it is not imitable. Apart from being the largest brand in technology, Samsung is also the leading spender in research and development focussed to drive growth. This investment brings in new innovation each year driving sales and revenue. Samsung is investing $15 billion towards the development of a new research and development complex aimed at designing new fabrication processes for memory and logic, and on next-generation technologies and materials (Shilov, 2022). This makes Samsung’s R&D a very valuable asset, rare and that not every company can copy. Samsung has a very good collaboration with its suppliers across the globe to source raw materials. It has set up an International Procurement Centre (IPC) which serves as the procurement hub in various locations which keeps an eye on varying trends and suppliers (Sustainable Supply Chain | Sustainability | Samsung US, 2022). This supplier network is a valuable asset and somewhat rare, but not entirely inimitable. Samsung holds a vast portfolio of patents in semiconductor technologies, manufacturing processes, design innovations which provides it with an advantage over its competitors. This helps Samsung to grow in all of its ventures, and in turn can pour in money towards R&D in ways other companies are unable to. Samsung has a total of 352,342 patents globally, of which 79% of them are active (Samsung Patents - Key Insights and Stats - Insights; Gate, 2023). This makes Samsung one of the largest holders of patents in the world and is very difficult to imitate by its competitors.

Company | Valuable | Rare | Inimitable | Organization | Conclusion |

TSMC | Workforce, Large scale Manufacturing 68860 patents | Open Innovation Platform | Customer Trust | Expansion in Taiwan for leading nodes mfg. | Sustained Competitive Advantage |

Samsung | Product Range, Supplier Network, 352,342 patents, Financial Reserve | Supplier Network, GAA technology | Product Range | Expansion in South Korea for leading nodes mfg. | Temporary Competitive Advantage |

Intel | Financial Reserve, 70000 patents, | Leadership, Government Support | Brand Positioning | Intel Foundry model and Expansion in US | Competitive Parity |

Table 1, VRIO Framework analysis

Having conducted the VRIO analysis on these companies in Table 1, we understand that Samsung and Intel are capitalizing and also working on acquiring more resources to a great extent in order to sustain a competitive advantage over another. TSMC is making use of its inexpensive labor market, advanced technology, and a great relationship with its customers to continue dominating in the manufacturing space. Intel is banking on its history, brand positioning, intellectual property, Foundry Model, and financial reserve to outdo its competitors. Samsung being the conglomerate, is making use of its huge product portfolio and large financial reserves to advance and innovate at an unprecedented rate. TSMC however, is the dominant of the three companies, being the largest dedicated semiconductor foundry in terms of capacity and market share. Intel and Samsung are formidable competitors in this space, having their unique strengths, glorified history and abundant capital, who are now focused to catch up with TSMC.

Core Competence Analysis

The core competence of a company reflects a competitive advantage possessed by the company which helps them maneuver through the industry and become successful. The advantage can be achieved from utilizing technology efficiently, setting up organizational processes, and internal communication to leverage skills of the resources. The core competence of the company is difficult to imitate by a competitor. We shall discuss the core competencies of the three selected companies hereafter.

TSMC- The core competencies of TSMC are technological leadership, customer’s trust, and skilled manufacturing and operations. This is evident from Figure 16 as it leads the pure-play foundry space by revenue. TSMC invented the foundry model in the semiconductor industry which depicted the highest form of trust. Prior to TSMC, customers were wary of intellectual property theft as the existing foundries would also compete with them in the same product segments. TSMC won the trust of the companies by stating that they are a pure play foundry and shall not compete with any of their customers.

Samsung- Samsung is a technological giant in the entire electronics industry. However, their semiconductor manufacturing segment ranks behind TSMC given that they are a company that has a diverse portfolio of products. The core competence of Samsung in terms of semiconductor manufacturing is research and development and intellectual property. Samsung is the leading company in the world in terms of US patent filings, with 352,342 patent filings out of which 77% are alive (Samsung Patents - Key Insights and Stats - Insights;Gate, 2024). A majority of their patent filings are under the CPC classification H10K which relates to sold state devices (Ellis, 2024) (CPC USPTO). However, Samsung has reported yield issues and is at a smaller scale than TSMC. Samsung’s foundry capacity is half of TSMC at mature nodes and one-third of TSMC at leading edge (Albert, 2022). Overall, Samsung needs to utilize its other core competence which is large capital investment and catch up with TSMC in order to build mature node capacity and compete at the leading nodes.

Intel- Intel used to be a dominant player in the semiconductor manufacturing industry with more than 80% market share in the microprocessors segment. However, Intel couldn’t produce 14nm node chips for 7 years which made it lag behind TSMC and Samsung. As a result, it is difficult to place technology as a core competence for Intel. However, Intel’s Intel Foundry Model launched by their new CEO, Pat Gelsinger, has revealed a roadmap beyond 1.8nm. If Intel can keep their yields high, then technology will once again become their core competence (Shilov, 2024).

Figure 16, Pure-play foundry revenue, 2020 (Hille, 2021)

Intel is also a major US player in the semiconductor manufacturing industry and provided critical defense technologies to the US making it an important strategic player for US plans of bringing chip manufacturing back to the US. As defense chips do not require leading edge nodes, Intel has a strong government relations and a core competency in serving the defense industry (Alcorn, 2021).

Generic Business-Level Strategy Analysis

TSMC- A variety of factors contribute to TSMC’s position viz., leading edge manufacturing with high yields percentage, Open Innovation Platform (OIP) for customers to improve their designs output, and partnering with their customers to acquire significantly higher customer trust (Open Innovation Platform® (OIP), n.d.). The OIP helps customers to churn out successful yields in their first attempts thereby reducing their cost of wafers and operations which drives down the manufacturing cost. Being a pure-play foundry, TSMC focuses solely on customer satisfaction and is therefore capable of implementing OIP across various segments for all kinds of customers. Thus, TSMC has a strong differentiation position in the semiconductor manufacturing industry.

In their 2022 Business Overview publication, TSMC claimed to have cost leadership over their competitors. (TSMC 2022 Business Overview). Given the giant market share that TSMC holds, it can leverage their competitive advantage of large volume, economies of scale and technology leadership to provide products at a lower cost to their customers. Additionally, TSMC has majority of its fabrication units in Taiwan where construction and labor costs are low. Thus, TSMC finds itself in a unique position to have cost leadership as well as differentiation in their business strategy.

Samsung- Samsung is well-known for its consumer electronics’ affordable segments which empahsizes that Samsung has cost leadership in particular segments as compared to the entire company. The same strategy is applied for the Samsung Foundry where it enjoys cost leadership in the memory segment of semiconductor manufacturing. The reason Samsung is able to do so is because of the high internal investments made. Samsung itself is the biggest customer of Samsung Foundry. Starting in 2000s, Samsung realized the need for memory chips like DRAM and NAND. During 2017 to 2020, Samsung Foundry invested approximately $93 billion in their foundry services which is used to buy equipment and therefore, mass produce chips in economies of scale. This allows Samsung to have cost leadership in the memory segment (Shilov, 2021).

Intel- Intel is struggling to achieve either industry-wide cost leadership or industry-wide differentiation. However, they used to have cost leadership in the microprocessor segment. Recently, with the arrival of their new CEO, Intel has received major government funding for investing in scaling manufacturing facilities across US and in Germany. This should allow Intel to achieve economies of scale in manufacturing. However, their processors are challenged by AMD, who is a customer of TSMC, and therefore they do not have sustainable cost leadership today (Shilov, 2021). Not surprisingly, Intel is an important customer of TSMC as well. Thus, the position of Intel along with TSMC and Samsung is shown in the Figure 17.

Figure 17, Generic Business-Level Strategy Analysis

Corporate and Cooperative Level Strategy Analysis

TSMC- The semiconductor supply chain involves a number of steps and functions to keep the system running efficiently such as Design, Manufacturing, Packaging, Testing, etc., and for a semiconductor company to be vertically integrated, it would mean to take control over all of these processes. TSMC didn’t buy the idea of vertical integration and the solution to it was to have its focus primarily on fabrication, and it solely specialized in the manufacturing of semiconductor chips as shown in Figure 18. The designs for it were made and provided by its customers. This strategy of TSMC saved huge sums of money which would have otherwise gone into making newer and better integrated circuit designs. TSMC’s focus on manufacturing does offer distinct business advantages as they are able to optimize its manufacturing process, invest significantly in research and development, and use its financial reserves to buy top quality manufacturing equipment. This helps TSMC optimize its entire manufacturing process, which leads to faster production times and lower overall costs per chip. By mass producing semiconductor chips for clients, TSMC is able to achieve cost efficiencies through economies of scale. In terms of diversification, TSMC can be considered to have incorporated a limited corporate diversification strategy as a single business firm, because most of its business activities are related only to the semiconductor industry. The recent chip shortages and geopolitical tensions has led TSMC to rapidly expand its manufacturing outside of Taiwan, and set up plants in Japan, US, and Germany. It is clear that TSMC does not follow the vertical integration model, but it does show signs of the horizontal integration model, as it collaborates with various stakeholders in the semiconductor industry. Thus, TSMC has limited corporate diversification as a single business firm. TSMC has the following 4 key partnerships which helps it gain expertise whilst it focuses on the manufacturing: Foundry Partnerships, Technology Partnerships, Supplier Partnerships, and Customer Partnerships. Apple Inc., is one such partner which has closely worked with TSMC since 2016 in producing chips for iPhones and iPads. Qualcomm is another example which has teamed up with TSMC to produce its Snapdragon processors used in mobile phones. Another notable alliance is with Nvidia which extends its expertise in AI, combining TSMC’s advanced manufacturing to produce high-performance AI chips. TSMC’s joint venture with ASML, globally known for its enhanced lithography equipment, will aid TSMC in developing high quality circuits on semiconductor chips (Who Are TSMC’s Joint Venture Partners? An Insider Look At Their Collaborations, 2024).

Intel- Since its founding in 1968, Intel has remained an IDM as shown in Figure 18. Intel designs and produces its own semiconductor chips under its brand name. This fully integrated approach has been foundational to Intel’s success. Intel can optimize both its manufacturing and designs as needed, and also price its products lower or higher unlike its competitors. Intel has also taken steps towards horizontal integration, and has slowly moved into other business segments with a very diverse product portfolio. Intel has the following segments through which it generates revenue: Client Computing Group (CCG) that produces processor systems for desktop, tablets, and notebooks, Datacenter and AI Group (DCAI) that focuses on data center products and leads the overall AI Strategy, Network and Edge Group (NEX), Accelerated Computing Systems and Graphics Group (AXG) which is into high performance computing, Intel Foundry Services (IFS) which provides manufacturing services, and Mobileye (MBLY) (Operating Segments, n.d.) focuses on driving assistance and autonomous driving solutions. Thus, Intel has related corporate diversification which are related-linked. Intel’s model is a very capital intensive model, as developing things from scratch and putting it out in the market is time consuming and expensive. Intel has therefore had to rely on mergers and acquisitions to secure new technology and maintain its organic growth in the market. Intel acquired Altera in 2015 for $16.75 billion dollars, which specializes in programmable chips. Mobileye, which is currently a segment in Intel’s operations, was acquired for $15.3 billion in 2017. On identifying security as a fundamental component of online computing, Intel acquired McAfee in 2010 for $7.68 billion. Shortly after the deal with McAfee, with the rise in mobile computing and seeing itself evolve with time, Intel acquired Infineon Technologies for its mobile chip business for $1.7 billion (Intel’s 5 Biggest Acquisitions of All Time, n.d.).

Samsung- Samsung is a big revenue generator in the semiconductor industry, but it applies the strategy of diversification like no other company. Samsung is diverse in the products and services they offer, some of which are: Electronics, Automotive, Apparel, Chemicals, Home Appliances, Medical Equipment, Consumer Electronics, Insurance, Vacations, High Caliber Healthcare etc. (Bhasin, 2023). Samsung has been known for adapting to changes in the market and driving innovation at pace. This is made possible through huge investments in research and development to drive technological advancements through its product portfolio, and a testament to this is their expenditure on R&D of $21 billion in 2023 alone (Samsung Electronics: Research & Development Expenditure 2023 | Statista, 2024). Samsung highly places emphasis on vertical integration by controlling its manufacturing, design, supply chain, retail, and distribution as shown in Figure 18.